Why Algorithms Price Differently from Humans

Exploring the computer's advantage

The decade between 1996 and 2006 was an exciting time for the ‘man vs. machine’ battle of wits, especially for chess enthusiasts. Within their calculating horizons, the computers seemed to make no mistake.

In these games against a computer, the computer had an advantage—its strategic moves could be made only by a computer, not a human.

One famous example is the ‘44th move’ in the first game of the 1997 match between the then-World Champion Garry Kasparov and Deep Blue, IBM’s chess machine. In this match, the computer played a seemingly random move (Rd1) before resigning.

A deeper analysis later revealed that the move would have postponed the upcoming checkmate until much later. It was reported that when Kasparov learned of this, he was so deeply shocked by Deep Blue’s capabilities that he resigned during his second game in a draw position.

Humans don’t—or can't—make computer moves because their benefits materialize much later and are not immediately apparent to human heuristics. The strategy to, for instance, “connect your rooks and place them on open files” is a foresighted decision many players cannot easily make.

However, these heuristics help human players understand many life situations. They don’t necessarily lead to the best results, but reliably to decent ones.

Computer moves differ substantially in their characteristics from human moves. For example, Artificial Intelligence (AI) chess engines like AlphaZero sacrifice material more often than humans.

What can chess computations teach us about pricing?

Like playing against the computer in chess, pricing managers must also cope with substantial complexity to optimize prices. More often than not, they resort to a collection of pricing heuristics.

One common interrogative states that, to price a good-better-best portfolio, you need three things:

- A low entry price to attract customers;

- A high price is the best option to increase customers’ willingness to pay; and

- A right-priced middle product that the customer is supposed to buy.

At Buynomics, we are building a pricing machine called Virtual Shopper AI to optimize offer structures and prices. Over the past months, we have conducted several A/B tests of the prices set by the Buynomics pricing machine against human-made prices.

The Buynomics pricing machine optimizes prices using Virtual Shoppers that make purchase decisions like their real-life counterparts to precisely predict how real customers react to price changes. Across the A/B test, machine prices significantly outperformed human prices.

How machine prices differ from human prices

To illustrate the comparison, we consider a café offering three coffee sizes. As a proxy for human prices, we looked around the cafés in the neighborhood outside of our office and found a typical price structure like this:

- Small (0.2l): €1.99

- Medium (0.3l): €2.99

- Large (0.5l): €3.99

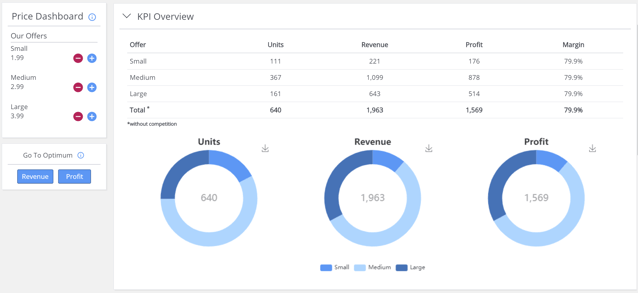

Figure 1: Sales with human prices

We modeled the purchase decisions of 1,000 Virtual Shoppers (Figure 1) based on actual preferences in similar situations. When offered the coffee portfolio, 367 out of the 640 who bought a coffee went for the medium size (57%) — probably confirming to the café owner that his pricing strategy worked.

Observation 1: The Buynomics pricing machine reduces the price spread in a portfolio

Compared to human prices, pricing machines reduce the price range in a portfolio.

As we observed, the price of the large coffee was reduced from €3.99 to €3.39 (Figure 2). This moved a large share of customers who would otherwise have chosen the small or medium-sized coffee to the large coffee size. In sum, this leads to a profit increase of about 6% (from €1,569 to €1,664), which comes mainly from the higher absolute € margin of the large coffee (with a lower % margin).

Reducing the price spread in a portfolio requires either increasing the entry price or reducing the top price. Both are risky unless you can precisely anticipate the volume reaction to price changes (here, -15% from €3.99 to €3.39).

This is very difficult with a back-of-the-envelope price elasticity calculation but effortless for a pricing machine.

Figure 2: Sales with optimized computer prices

Observation 2: The pricing machine identifies areas of very large price elasticity and exploits these situations

Most pricing professionals consider a price elasticity below -4 very high and would not change a price if it required an elasticity below -6 to be profitable. However, price elasticities can be very high in portfolios with close alternatives.

Figure 3 shows the price elasticity of the large coffee ranging between €3 and €5. At the starting price of €3.99, the price elasticity (for a price increase) is -8. The pricing machine can work with such high price elasticities and use them to optimize the portfolio offer.

Figure 3: Price elasticity of the large coffee (with small at €1.99 and medium at €2.99)

Note that actual price reactions can be even more extreme. In a recent pilot, our pricing machine reduced one price in a portfolio by 36%, which increased sales (as predicted) by a factor of 25! That is, not +25%, but +2400%, which puts the actual price elasticity at about -67.

Conclusion

These are exciting times to be in pricing! As the two observations indicate, machines have much to contribute and will soon make many established heuristics obsolete. These intelligent tools enable a highly efficient and robust replacement of complex computational operations, making companies more profitable.

At Buynomics, we are just getting started. Follow us on our journey as we explore and share many more observations.

For now, however, we want to leave you with a thought:

Alpha Zero, the AI-based chess engine, sacrifices material more often than humans in exchange for a positional advantage. However, that does not necessarily mean it will be the stronger player.

Similarly, simply applying the observations in pricing will not work, as reducing the price spread in a portfolio may not necessarily increase profits. In the 'man vs. machine' conflict, the machine cannot replace a human; it can only provide humans with the right tools to improve.

Contact us if you want to explore how Buynomics can help you optimize your company's pricing.

November 22, 2022

.png?width=520&height=294&name=BYN_Resources_Blog_Banner%20(9).png)