How to Win Customers with Behavioral Pricing

How do shoppers decide what to buy? This is the million-dollar question that revenue and pricing managers need to answer.

It has little to do with rationality. In fact, shoppers are often irrational and impulsive, influenced by psychological, social, and situational factors when purchasing. That is why behavioral pricing is key to winning over your customers.

To effectively set prices based on your customers’ behaviors, it is essential to understand behavioral science. In this blog post, we cover:

- What is behavioral pricing?

- Why consumer behavior is crucial to your pricing strategy

- Top behavioral pricing effects

- Three behavioral pricing examples

- The best tool to help you make informed pricing decisions

What is behavioral pricing?

Behavioral pricing is the practice of setting prices based on consumer behavior patterns. These patterns are found by analyzing data on consumers' psychological, emotional, and behavioral features.

This practice is one part of behavioral economics [1], which uses elements of economics and psychology to understand how and why people behave the way they do in everyday life.

Why consumer behavior is crucial to your pricing strategy

Consumer behavior eventually determines your sales, revenue, and profits. Understanding it allows you to make informed pricing decisions, helping you achieve your business goals and maintain a competitive edge in the market.

Understanding how customers perceive the value of your products or services, which influences their willingness to pay, is inevitable. This helps your business set prices for your target market, maximizing your revenues and profits while staying competitive.

Understanding consumer behavior also helps you effectively react to market dynamics and adapt your strategy based on economic conditions, trends, and competitors.

Staying responsive to these changes earns customer satisfaction and loyalty because you show that you can align with the customer’s values and needs.

Top behavioral pricing effects

The following overview shows a selection of the most important behavioral pricing effects, which comprise over 95% of the effects we have seen in the market in our 20 years of pricing experience.

Important to note: Don't use all these effects together. Consumers can only absorb a limited amount of information when buying your products, and using too many may reduce the impact. Based on our experience, we recommend limiting to 3-4 effects in grocery retail and 4-6 online (e.g., in telco or consumer software) with less additional information (e.g., competitor offerings) to influence the shopper’s purchasing decision.

1. Default nudge: Nudging is the predictable altering of shopper behavior through positive reinforcement. When you create a default nudge, you suggest, for instance, that the default option is the most commonly chosen one. This tends to sway your customers to choose the default product. It also includes highlighting a product on your website as a "preferred option" or using naming conventions like "standard product" vs. "plus product.”

2. Power of free: The Zero Price Effect is the phenomenon of shoppers tending to choose a free product more often than its inherent utility would suggest. The effect is explained by Dan Ariely in his book "Predictably Irrational" [2] and is leveraged by sellers who throw in free goodies with the standard product option.

Buynomics conducted a study showing that this effect could actually be limited in applicability.

3. Price anchor: A price anchor sets buyer expectations at a certain price level. This is often used to make the list price look comparatively cheaper. This strategy is often used in discounting and referencing a hypothetical price recommendation. It’s best to only use this when you actually discount a product—it’s a lot easier to lose customer trust than to gain it!

4. Price thresholds: One of the most commonly known behavioral pricing effects is the price threshold, also known as odd-even pricing. Buyers tend to behave irrationally when they see, for example, "$9.99" instead of "$10." This is especially true when a threshold moves by a decimal, i.e., $0.99 vs. $1 or $9.99 vs. $10.

However, companies have recently started adopting even prices, e.g., $10, $20, or $30, to suggest high quality or value. Is this based on an erosion of the price threshold effect in certain industries? Maybe—the science is not yet in.

5. Time-limited offers: Time-limited offers, also known as urgency-based pricing or limited-time promotions, is a behavioral pricing technique that leverages the psychological principle of scarcity and the fear of missing out (FOMO). Using limited-time discounts or promotions can create a sense of urgency, encouraging customers to make quicker purchasing decisions to take advantage of special pricing.

6. Reference price: Reference pricing is the act of pricing products relative to one another. As buyers decide between different products, it is highly important to have the right reference price for each product both within your own portfolio and compared to your competition.

By seeming more or less valuable compared to other product offerings, you can influence buyers' inclination to buy your product.

7. Endowment effect: The endowment effect describes buyers' tendency to place a higher value on a product once they own it. In pricing, a free subscription period or trial can take advantage of that effect as buyers are more willing to pay for something they already "own" and use regularly.

Three behavioral pricing examples

The behavioral pricing strategies listed above are used across industries to leverage consumer psychology and influence purchasing decisions in every environment.

Many experiments and practical examples have shown that shoppers are far from rational. Here’s one popular anecdote:

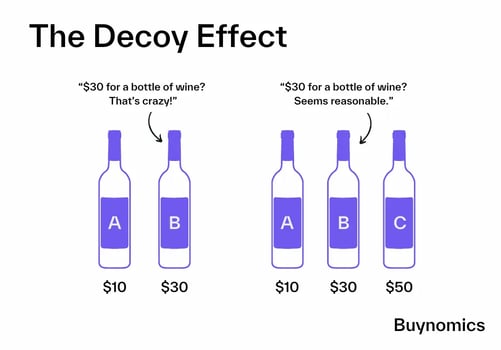

Consider a wine vendor who offers two different types of wines: a good wine A for $10 and a better wine B for $30. It turns out that 54% of customers buy wine A, and 46% buy wine B. This is because most customers find it difficult to judge the quality of a wine, and they don’t want to overspend.

Then, the vendor adds an additional wine C at a price of $50. It serves as a decoy, making the price of wine B appear much more reasonable.

Now, 15% of customers choose wine A, 73% wine B, and 12% wine C. Customers switch not only from wine A and B to C, but also from A to B.

This behavioral phenomenon violates the “independence of irrelevant alternatives” [3] axiom of classical economics.

Given two options, some may opt for a low price while others opt for perceived quality. When a more expensive decoy is added, more are pushed to choose the medium-priced option.

Revenue managers frequently use this example and the decoy effect to justify adding an additional premium option to a product range.

How does behavioral pricing look in the real world? See if you’ve run into any of these strategies in your daily life:

1. Supermarkets

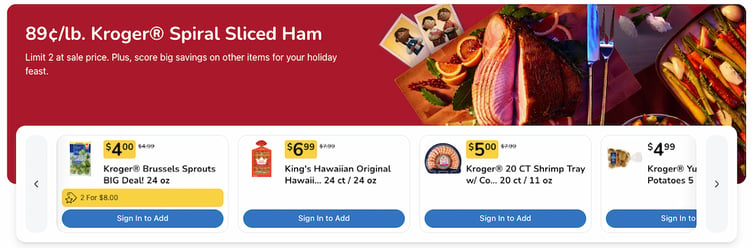

According to a study on pricing behavior in supermarkets [4], consumers who shop for low prices are more likely to visit competing chains. This means competition between retailers affects sale decisions, so supermarkets need to employ strategic pricing decisions and promotions to stay competitive.

For example, supermarkets strategically use odd-even pricing to price items with a .99 ending (e.g., $9.99) to create the perception of a lower price.

Other behavior-based strategies include price anchoring, loss leaders (offering products at minimal profit to attract customers), and strategic promotion timing.

Kroger made it simple for customers to click and buy everything they need for a holiday meal at promotional prices.

The goal is to satisfy customers by offering low prices, regular promotions, and discounts while protecting margins. Revenue growth management teams leverage machine learning software to stay competitive in consumer packaged goods (CPG), which is necessary in such a volatile market.

2. E-commerce and online retail

Online retailers frequently adjust product prices based on factors such as demand, competitor pricing, and the user's browsing and purchasing history.

Limited-time offers, flash sales, bundle pricing and countdown timers create a sense of urgency and encourage quicker purchasing decisions. Online stores also use price anchoring and loss leaders to pivot certain products as deals.

Target promotes its Circle rewards program by offering members one-day-only deals at competitive prices.

Target promotes its Circle rewards program by offering members one-day-only deals at competitive prices.

E-commerce has more targeting options simply because of data. It’s easier to track consumer behavior online, making it easier to refine their behavioral pricing tactics.

3. Airline tickets

Perhaps you’ve heard this before: “Tuesday is the best day to book a flight!”

Airlines are notorious for using behavioral pricing based on factors such as time and day of booking, demand, and historical purchasing data.

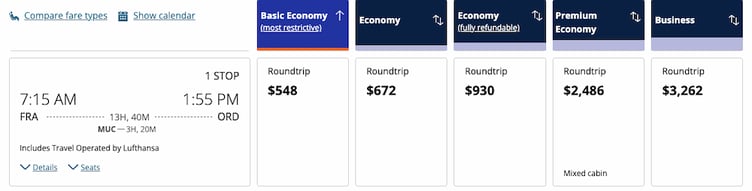

For example, United offers four different price levels for an economy seat.

Which fare would you choose?

Which fare would you choose?

The cheapest option doesn’t allow a checked bag, a refund, or even a guarantee that you’ll sit with your family. The next step up costs $124 more and offers a checked bag and chosen seat.

Do you spot the decoy effect at play? A $2k premium economy seat makes the $672 economy option look extremely reasonable.

Create a better behavioral pricing strategy with Buynomics

Examples and anecdotes such as the ones presented above are well-known among pricing professionals, and they are frequently used to justify making changes to a product range or pricing strategy. However, beyond anecdotal use, it’s unclear how to best use behavioral effects.

In the wine example, is $30 really the best price for wine B? Also, what is the optimal decoy price? If it’s too detached from the other prices, it loses its effectiveness.

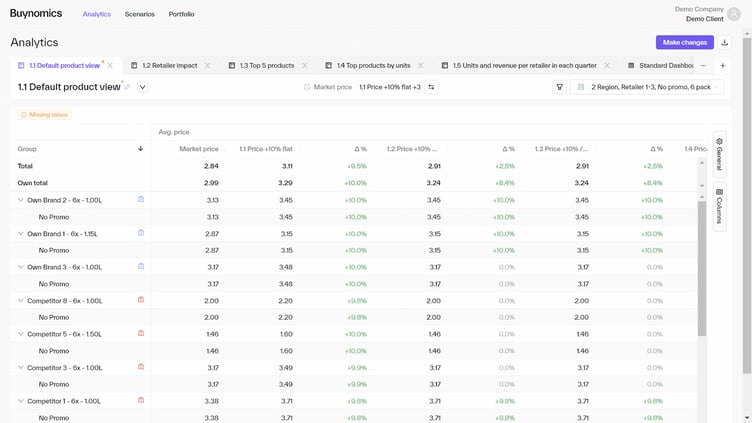

To fully leverage behavioral effects, pricing professionals need to be able to model how customers react to different prices of decoy C as well as wines A and B. This is where machine learning-powered solutions, like Buynomics, are beneficial.

Buynomics allows you to simulate price and product changes, including those of your competitors, to see how consumers react.

Buynomics allows you to simulate price and product changes, including those of your competitors, to see how consumers react.

Buynomics’ pricing platform enables this analysis and modeling and helps pricing professionals optimize their prices and product offers using Virtual Shopper AI.

Virtual Shoppers behave like your consumers, and you can turn their susceptibility to a variety of behavioral tricks, like a price decoy, on and off.

Once behavioral effects are understood and parameterized correctly in the platform, you can then use them to optimize the effects and your offer beyond the purely anecdotal impact we showed above.

Skip the anecdotes and utilize the full power of behavioral pricing with Buynomics. Get in touch with us today.

Resources

January 04, 2024

.png?width=520&height=294&name=BYN_Resources_Blog_Banner%20(9).png)