The Future of Pricing Strategy and Revenue Growth Management

Life is oddly complex. Even everyday events like the results of soccer matches, the weather, or financial markets seem very difficult to predict. Luckily, there are often simple rules that can provide strong guidance.

If you bet on a 2:1 victory of the stronger team in a soccer match, you have a better chance of being more accurate than the experts on TV. In meteorology, the forecast “tomorrow will be just like today” is correct about 2 out of 3 days and was, until recently, better than most professional predictions.

In finance, simply buying the market portfolio will beat most other investment strategies. So, how can these predictions be applied to your Revenue Growth Management (RGM) strategy?

Optimizing prices in Revenue Growth Management is harder than expected

Unlike other predictions, pricing is challenging. In Revenue Growth Management, we want to understand what product offerings and prices would optimize revenue or profit. Here, cost-plus pricing is a simple rule that produces decent and reliable results.

According to Harvard Business Review, despite being ridiculed by many pricing professionals, cost-plus pricing is still widely and successfully applied by RGM decision-makers worldwide. To counter this, pricing professionals have introduced many ideas that typically emphasize the customer and competition rather than the product and its costs.

Two prominent examples are value-based pricing and price elasticity-based pricing. Yet, both often fail to perform better than cost-plus pricing because they build on oversimplified core assumptions.

Value-based pricing leaves room for a variety of errors

In value-based pricing, companies typically replace a group of customers with ‘the customer,’ an average customer in a segment that makes market situations easy to understand. The joke about the statistician who missed the rabbit first to the right, then to the left, and then claimed that the rabbit is dead—based on an average—is well known.

Similarly, the first mistake revenue growth managers make is tailoring their products and pricing to some hypothetical average customer who does not exist in the real world.

The second mistake arises from focusing solely on value and ignoring costs.

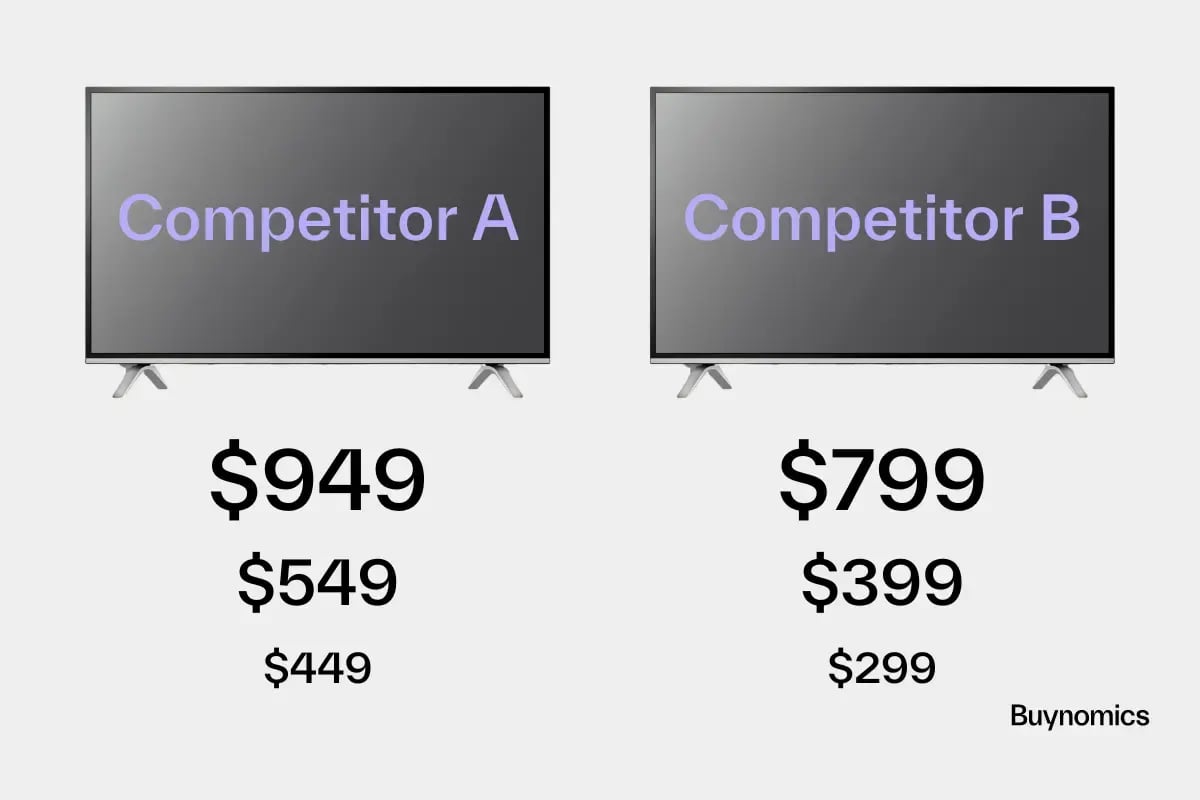

These mistakes can be detrimental, particularly in the case of slim margins. The Harvard Business Review explained value-based pricing by considering two competitors, A and B, in the big-screen TV market segment, each offering one TV model.

Competitor A determines that her offer is worth $150 more because of customer preferences than Competitor B’s offer. By pricing relative to the next best offer—B’s TV at $799—A determines a value-based price of $949. If B reduces the price to $399, then A must follow their price at $549. There is a definite possibility that this process can quickly turn into a loss for A if they do not consider costs.

Value-based pricing often neglects to consider how profit or revenue is affected by the price difference between products (here, A’s and B’s TVs) at different price levels.

Certainly, value-based pricing can be improved—and often is—if companies base it on a conjoint study and market simulation. However, conjoint studies are costly and lengthy and, thus, only applicable in limited RGM situations. In addition, they are inflexible and cannot easily be adjusted to answer new questions.

Using price elasticity to compute volume reactions to price changes is another example of a dangerous conceptual oversimplification.

Frequently, such calculations implicitly assume that elasticity is constant or that the price demand function is linear across a larger price range.

These assumptions might be acceptable in a market with just one product. However, they can be grotesquely wrong in a market with multiple products and competitors. If a price increases above a close competitor's, the elasticity can easily jump from -2 to -10.

Price elasticity suits educational or recreational pricing exercises and back-of-the-envelope estimates but not for actual price decisions, especially where real money is involved.

The differential calculus on which elasticity calculation is based was used to calculate the motion of the moon with pen and paper 1,500 years ago. Astrophysics has long moved forward and now relies heavily on computer simulations.

Therefore, it is time for pricing to also take the next step and leave pen and paper behind.

We need more precise pricing tools for the future

For a true leap into the future of Revenue Growth Management, companies must base pricing on a precise model of the underlying purchase and market dynamics.

For example, consider Nate Silver’s comparison of weather and earthquake forecasting progress in his 2012 best-seller “The Signal and the Noise.”

Despite what you may think, weather forecasts have improved significantly over the past decades. Why? Meteorologists have developed better computer models of weather dynamics to simulate, for instance, the movement of clouds or the build-up of storms. The more precise the model and the faster their computers, the better their predictions.

On the other hand, earthquakes remain notoriously unpredictable. The tectonic dynamics that cause earthquakes are still largely unknown because they happen deep under the earth's surface, hidden from sight. The history of science teaches us that a clear understanding and modeling of the underlying dynamics is the starting point of improvement.

Similarly, we must get the consumers’ behaviors right to get pricing right.

Just like the weather dynamics in meteorology, we need a model of consumer behavior. However, much like the tectonic dynamics in geology, today’s pricing concepts are mostly blind to the underlying dynamics responsible for customers’ purchases and, thus, are not improving.

This is where using the proper pricing tools comes into play.

Unhappy with this situation, we developed Buynomics

Buynomics is a technology that fully uses recent advances in large-scale computer simulations, extensive data analyses, and artificial intelligence (AI) to model customers' buying behavior.

Using our Virtual Shoppers AI, Buynomics combines market data such as sales figures, price information, expert knowledge, and market studies with knowledge from our customer behavior database.

AI-powered algorithms use these insights to invigorate virtual shoppers who behave just like their real-life counterparts. These insights then give RGM professionals full transparency on steering and optimizing for sales, revenue, and profit.

With available market data, Buynomics can beat conjoint-based pricing in established markets. Our platform precisely predicts how price and product choices affect sales and pinpoints the best pricing strategy to optimize revenues or profits.

As a true software solution, Buynomics can economically price large portfolios and not just select high-value products.

Get Started Today to Reach Your Goals Tomorrow

Request a free consultation today to see how Buynomics can support your RGM team and help you make data-driven decisions.

October 26, 2022

.png?width=520&height=294&name=Blog%20Quote%20Images%20(12).png)