5 Benefits of Pricing Tools + Top Solution

It’s time to fuel your pricing decisions with AI. We’re in a new era where businesses can leverage the latest technology to modernize their pricing strategies and make faster, data-driven decisions.

In this post, we discuss:

- What is a pricing tool?

- The evolution of pricing tools

- The benefits of using an advanced pricing tool

- Buynomics: Get started with the best AI pricing tool

What is a pricing tool?

A pricing tool’s purpose is to support businesses in identifying the optimal price for their products or services and define optimal price strategies. Modern software tools leverage large amounts of data, advanced analytics, and sometimes artificial intelligence to provide insights into customer behavior, market environments, and developments over time.

Pricing tools help businesses set prices that maximize their profitability, maintain competitiveness, and align with their overall business goals.

But how do today’s modern pricing solutions compare to legacy solutions like Excel?

Exemplary pricing model in Excel.

While Excel has some advantages, such as flexibility, cost, and simplicity, they’re outweighed by its numerous disadvantages:

- Lack of integrations

- Little to no predictive modeling

- Scaling limitations

- Limited application of AI

This makes Excel a poor choice if you want a modern solution that automates processes and insights for your team and takes accurate and realistic customer behavior into account.

The next generation of pricing tools offers many benefits and, in turn, makes the lives of today’s pricing teams easier. These new tools provide a way to interpret and integrate product, sales, competitor, and cost data sources with customer preferences, among many other benefits.

The evolution of pricing tools

Pricing has always existed. From the ancient abacus to the calculator of the 1960s to the standard 1980s Excel spreadsheets, people use the tools of the time to price a product. In fact, most large enterprises still use Excel as their tool of choice.

How pricing tools have evolved over time.

However, there’s horror stories about companies that gatekeep their pricing tools and algorithms, only to find that they’re constantly underperforming against their competition, driving away customers, and finally missing out on profits.

By embracing the power of AI pricing tools, businesses can take advantage of modern pricing optimization. In Revenue Growth Management (RGM), this is particularly important considering the increasingly competitive landscape and pressure to correctly charge customers or risk losing them to competitors.

“The playing field is poised to become a lot more competitive, and businesses that don’t deploy AI and data to help them innovate in everything they do will be at a disadvantage.”

- Paul Daugherty, chief technology and innovation officer at Accenture

Pricing is critical to your business. Learn how you can avoid costly miscalculations, keep up with competitors, and optimize your product mix with just one intelligent platform.

The benefits of using a pricing tool

1. Empowers data-driven decision-making

In RGM, many managers still rely on guesswork and intuition. When you consider that data is becoming more complex, it’s a mistake to make difficult commercial decisions based on your gut feeling.

Only with data can you truly verify, understand, and quantify your decisions. The only way to do this with confidence is with AI-powered software. It feeds on large amounts of data and can interpret it quicker than any human, and with marginal error. It combines multiple data sources, making it a single source of truth for your decisions.

2. Keeps you agile

Rapidly changing market conditions require businesses to adapt quickly. Pricing tools keep you agile and allow you to respond promptly to shifts in customer behavior, market trends, or competitive landscapes.

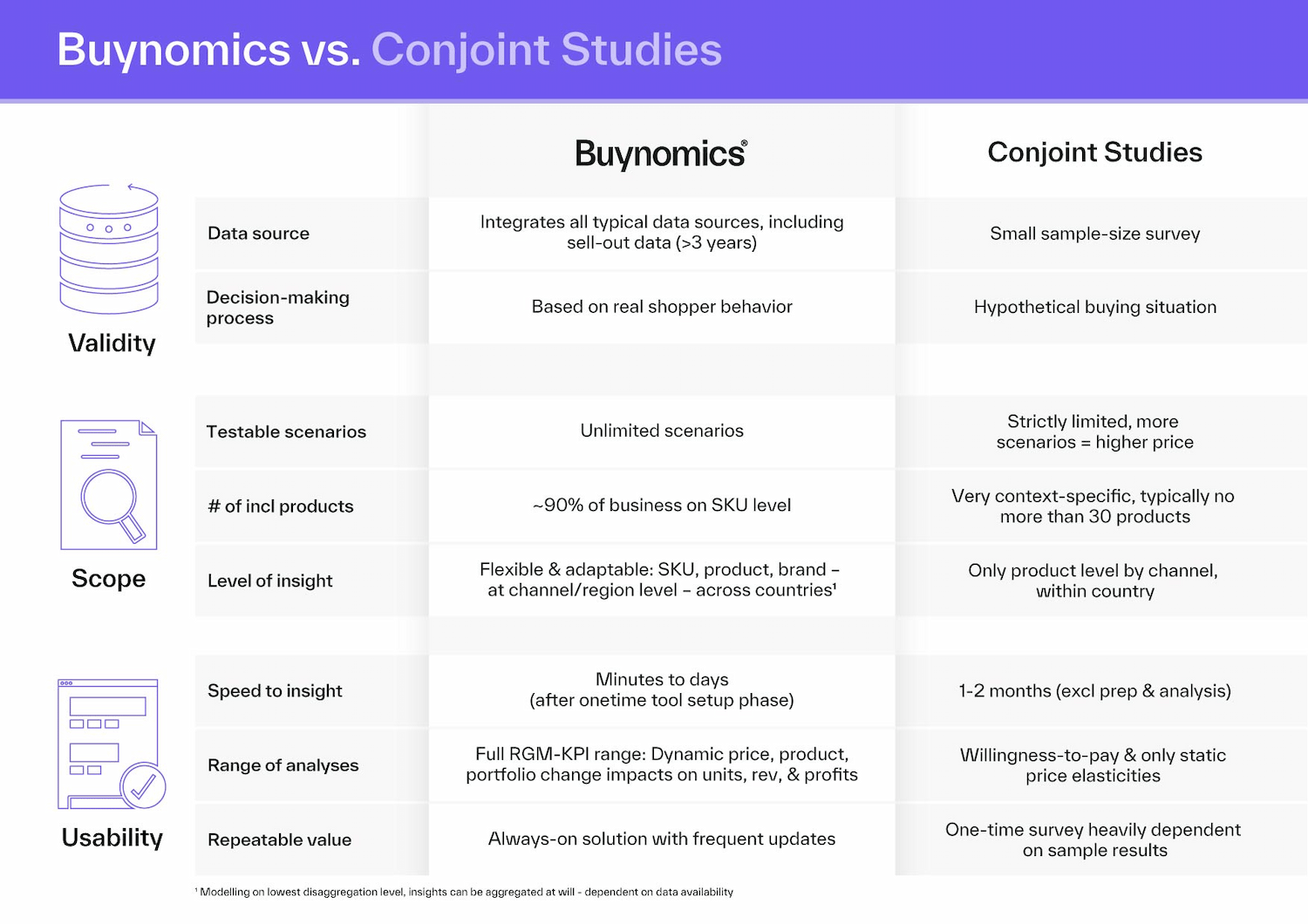

Platforms, such as Buynomics, provide real-time data, which helps you sell according to real customer behavior instead of hypothetical conjoint studies.

By regularly monitoring and analyzing competitor pricing, your business can adjust its own pricing strategies to maintain a competitive edge in the market.

Your shopper never stands still, so you can’t afford to either.

3. Provides instant forecasting

Many of the top problems we hear from consumer packaged goods (CPG) companies revolve around forecasting:

- Limited forecasting capabilities exist to measure the expected impact of price and promo changes on KPIs

- With rapidly changing market environments, it becomes increasingly difficult to holistically forecast shopper behavior

- Simulations and forecasting are mainly done manually, which is extremely time-consuming and costly

SaaS-based pricing tools streamline business forecasting, offering an intuitive platform to simulate pricing strategies and their outcomes. You can quickly input different variables to perform an instant, comprehensive analysis of the impact on your business.

4. Saves time and resources

Software-based pricing tools allow you to perform fast iterations of scenario simulations, cutting the time and effort you spend manually analyzing your data and setting prices from months down to minutes.

By delivering actionable insights in real-time, SaaS pricing tools empower your business to make quick, informed decisions, optimize resource allocation, and maximize your team’s productivity.

5. Impacts your top line

Through optimization, pricing tools help businesses maximize their top-line KPIs, such as revenue or profit.

Major fast-moving consumer goods (FMCG) companies reported profit uplifts of 2-4% and improved pricing and product architecture thanks to machine learning software.

Take Buynomics—it can assess combined changes of RGM levers such as pricing, price pack architecture (PPA), and promotion optimization, which isn’t possible via traditional methods. It can also instantly report how your shoppers will react to these changes using machine learning to replicate their buying behavior.

This leads to better strategic decision-making, resulting in top-line growth.

Buynomics: Get started with the best AI pricing tool

Buynomics is a SaaS-based solution that leverages AI-driven technology to help CPG companies tackle persistent challenges.

Our Virtual Shopper AI creates millions of virtual shoppers who behave exactly like their real-life counterparts. This enables you to easily test pricing, price pack architecture, channel, and portfolio strategies without any risk and assess their real-world impact.

Buynomics’ holistic approach considers the effects of all product portfolio changes.

It is the only solution that forecasts shopper behavior with up to 95% accuracy. It successfully simulates an unlimited number of price, product, and promo combinations to precisely predict how demand will react to your offer changes, resulting in better and more profitable pricing decisions.

Compared to other pricing tools, Buynomics has a fast implementation and onboarding time, as short as 6 to 10 weeks. Your team also receives hands-on advice on how best to use the software so you get the most out of the platform.

Key features:

- Create unlimited scenarios and see immediate impact from offer changes

- Use our channel optimization to plan your offer and trade terms for each channel

- Refine your core KPIs in just a few clicks using KPI comparisons

- Simulate competitor actions to plan your response

- Use the analytics suite to gain instant & profound analytical insights, including elasticity- and demand curves, for all your products

Get in touch with us today and discover how Buynomics can become your ultimate ally in improving decision-making for more profitable outcomes!

Talk to an expert.

March 19, 2024

.png?width=520&height=294&name=Analytics%20Orgs%20Use%20-%20grey%20(1).png)

.png?width=520&height=294&name=BYN_Resources_Blog_Banner%20(9).png)