Why is B2B Pricing Important?

B2B pricing is a large field that deals with the pricing of business customers.

The two pictures in Figure 1 capture the difference between B2C (business to consumer) and B2B (business to business). Consumers tend to purchase more spontaneously and emotionally, while businesses’ purchase decisions are more rational and follow a planned process.

But what does this imply for pricing? In this blog, we provide an overview of the specific challenges of B2B pricing by looking at its B2C pricing roots and then highlighting how the specifics of B2B affect pricing.

Figure 1: B2C vs. B2B pricing

B2B Pricings’ B2C Roots

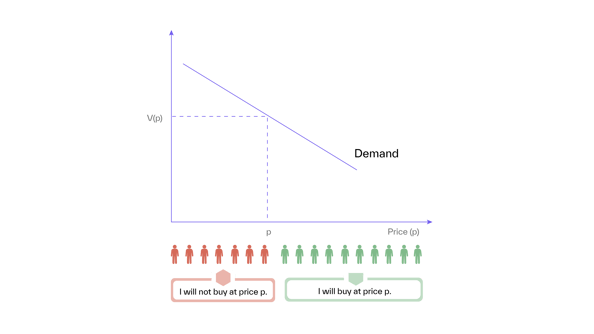

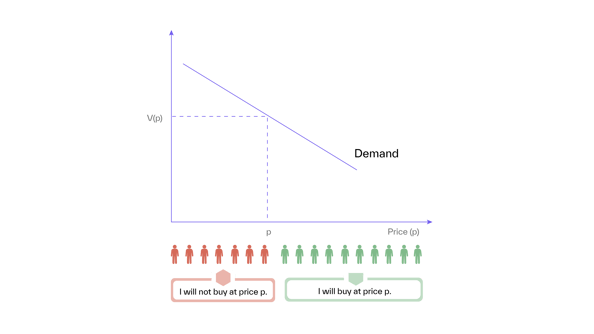

Most pricing concepts have, at least implicitly, a consumer on the demand side in mind. For example, pricing managers need the assumption from classical economics that demand functions are continuous and differentiable to compute price elasticity. This assumption implies many atomistic buyers, each with only minimal relevance (see Figure 2).

Figure 2: Market equilibrium in classical economics

Competitive pricing, i.e., pricing relative to key competitors, is very common in B2C. It is omnipresent in online retail, where price crawlers easily collect competitor prices. In B2B, on the other hand, competitors’ offers and prices are generally not transparent and are, therefore, difficult to consider for price decisions.

Measuring customers’ willingness to pay via large-scale studies is a viable option for consumer products but very difficult for B2B products, as relevant study participants are difficult to find and interview.

Moreover, the relevance of business customers is often highly skewed, with few key accounts comprising the majority of sales. That is why conjoint studies, for example, are much less common in B2B, and assessments of customers’ preferences and the value they attribute to a product often rely much more heavily on expert judgment and gut feeling.

Together, these reasons make the direct application of many pricing tools, such as price elasticities or value pricing, difficult in B2B.

B2C vs. B2B Pricing: Same, Same, but Different!

B2B pricing is not limited to a few industries. It covers a wide variety of diverse products and services, including professional services, such as lawyers or accountants, software, machinery, or logistics—in short, everything businesses need to flourish.

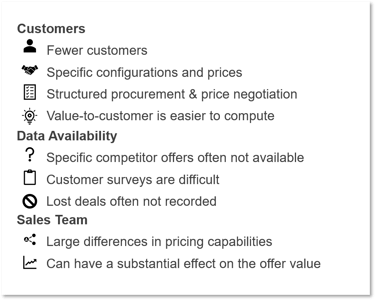

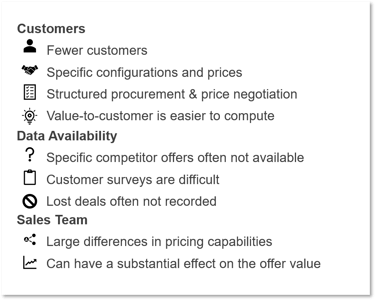

Overall, these applications vary greatly, but they also have many important common factors in terms of pricing. Figure 3 summarizes the key common factors of B2B pricing.

Figure 3: Common characteristics of B2B sales

Essentially, customer specifics matter more in B2B pricing than in B2C pricing. Companies tend to have fewer B2B customers with specific needs that need to be addressed when configuring offers and setting prices.

On the other hand, the value a product or service provides to a business customer, be it in the form of a saving or an increase in sales, is often easier to assess than consumers' willingness to pay.

Furthermore, relevant pricing data is often unavailable. Customer insights (e.g., from conjoint studies), competitor price information, and proper sales data are under- or unreported in B2B companies. For example, many companies do not systematically collect data on their lost deals. However, together with the won deals, this provides crucial insights for pricing.

Simply put, to get the price right, you need to know when it was too high in the past. A sales rep with a high average selling price might be losing too many deals and is not a good reference point for others.

Additionally, the impact of the company’s sales team on pricing is often difficult to assess. If different sales managers achieve different prices for the same products, this can result from variances in their customer bases, pricing and negotiation capabilities, or the value they provide customers.

For example, one saleswoman solves her customers’ business challenges 24/7, while her colleague does not. Consequently, her customers are willing to pay a premium for the products she sells. Such differences have strong implications for pricing. Should sales representatives, then, have different price targets depending on the extra value they provide to customers?

Due to the large differences between business customers’ needs and the non-transparency of competitors’ offers and prices, differentiation has become the central theme in B2B pricing.

Why Differentiate Prices?

On the one hand, B2B prices need to be differentiated because business customers often require specific product configurations. On the other hand, pricing uses differences in products’ value to customers and differences in the relative negotiation strength to differentiate prices and maximize profits.

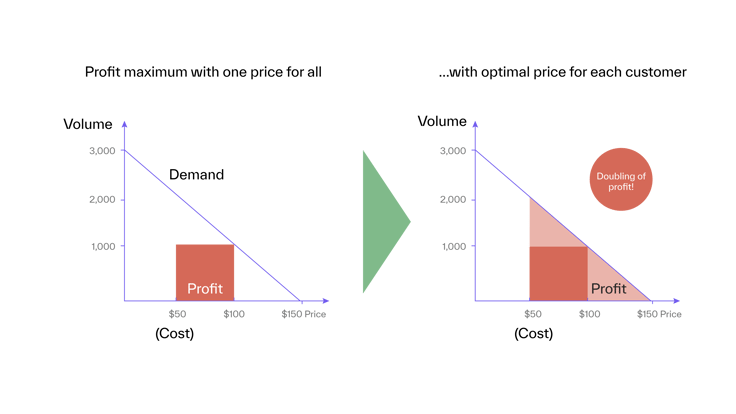

The benefit of price differentiation is usually justified with the argument shown in the example in Figure 4.

Figure 4: Difference in profit between a single price and the maximum price for all customers

A firm sells a product in a market with a maximum demand of 3,000 units. The maximum willingness to pay is $150, demand is linear, and unit costs are $50.

Then, the (single) profit optimal price is $100, with resulting sales of 1,000 units and a profit of $50,000 (left side of the graph). However, if each customer pays a price equivalent to his maximum willingness to pay (right side of the graph), then the achievable profit is $100,000—twice that of the single-price optimum.

While the benefit of charging each customer his individual maximum is clear, a word of caution is also required.

For price differentiation to be more profitable than the single price, the firm needs to know each customer’s precise willingness to pay. Otherwise, it will lose many customers when it overcharges in an attempt to price the maximum.

Get Started Today to Reach Your Goals Tomorrow

Request a demo today to see how Buynomics supports your Revenue Growth Management (RGM) team and helps you make data-driven pricing decisions.

.png?width=520&height=294&name=BYN_Resources_Blog_Banner%20(4).png)

.png?width=520&height=294&name=Website%20Blog%20Featured%20Images%20(9).png)