How to Optimize Pricing and Revenue Amidst Inflation

While inflation may be the scariest thing for most companies, it can also be a blessing in disguise when optimizing prices.

In this blog, we will discuss:

- How inflation can become an opportunity

- Three ways to stay competitive amidst inflation

- The shortcomings of your existing tools

- How Buynomics helps you succeed

We are slowly shifting into disinflation mode. In 2022, the U.S. experienced a 9.1% price surge, the biggest increase since November 1981. However, the consumer price index (CPI) rose 3.0% this year, the smallest rise since 2021. This means the current annual inflation is just a third of what it was last June.

While we are still experiencing inflation, which is scary for most companies regarding pricing, this challenge presents unique opportunities.

It's like in Formula 1:

“If the sun is shining, a good driver can overtake one car per round; if it is raining, he can overtake ten.”

Competing in today’s environment is much like car racing. If conditions are normal, the differentiator is your car—or, in your case, the overall condition of your company. But if conditions are difficult, it all comes down to the driver’s skill—or, in your case, how agile and prepared your revenue management and pricing organization is.

Bottom line: Inflation is a valuable opportunity for great revenue managers and companies to advance! But why is that the case, and how can you stay ahead of the curve?

How Inflation Can Become an Opportunity

While product and pricing decisions are always impactful, an equilibrium develops in mature markets in normal times.

One-sided deviation from this equilibrium—especially changing prices—is often impossible. External shocks, like inflation, disrupt this equilibrium and open opportunities.

Three main factors add dynamism:

Customers change their behavior

Customers are likelier to change their spending behavior or price sensitivity to certain goods. This highly depends on the category and how income grows compared to inflation.

Figuring out the dynamics in your industry and region is key to making the right decision.

Costs change

Inflation influences the costs of goods sold (COGS) depending on your industry. If you produce bread, for instance, an increase in flour costs is a challenge because customers don’t care about your costs.

You need to optimize your pricing, given both costs and price sensitivity. The key to success in pricing amidst cost inflation is being able to do so.

Competitors change prices, promotions, or products

Inflation is an exogenous event that affects most of your competitors in similar ways. However, they will not all react similarly, and their actions will not have predictable effects.

One of the most important factors to consider when planning your pricing is competitors' changing prices or pack sizes. Consumers will then decide between you and their next best offer.

In a situation where changes in competitor prices are happening more frequently and are becoming more significant, it is crucial to quickly understand the new circumstances, as they bring both opportunities and threats.

Three Ways to Stay Competitive Amidst Inflation

To emerge stronger in this new situation, these three steps are necessary:

1. Diagnosis: Map the new territory

-

Understand and quantify customer behavior changes.

-

Understand cost changes and their implications on your product cost and margins.

-

Gather information about your competition’s price, product, and promotion changes and understand its impact on your offering.

2. Guiding policy: Harvest opportunities shown by the diagnosis

-

Create general guidelines on how to deal with the new situation.

-

These can be existing or new guidelines, e.g., a focus on market share in segment A, no price increases higher than x%, and at least y% below competitor A.

-

3. Coherent actions: Concrete steps

-

Determine concrete actions to benefit from the opportunities found in the diagnosis considering the guiding policy.

-

For example, offer product X in channels A and B, increase the price of product X while decreasing the prices of products Y and Z, and change promotion Y for product X in channel A.

-

The challenges to follow through are mainly in steps 1 and 3.

Diagnosis: Even though data is available, the tools to make sense of it are missing. This is particularly true for customer behavior.

Coherent actions: Decisions are avoided due to high uncertainty about how customers will react to offer changes.

However, existing legacy tools don’t provide clarity on market reactions.

The Shortcomings of Your Existing Tools

Here are the main reasons your existing tools keep you from remaining competitive in an inflationary environment.

Consumer behavior is oversimplified:

Excel-based models and “leading” pricing software often use elasticities or cross-elasticities. In our blog post, "Price Elasticity—the Good, the Bad, and the Ugly," you’ll learn that elasticities condense consumer preferences to one number. The more changes in the market, the more error elasticities and cross elasticities are included.

Costs are not harmonized with prices:

In most pricing solutions, costs are not properly harmonized with prices. They either put too much weight, e.g., on cost-plus pricing, or too little, e.g., on elasticity-based pricing.

As most professionals know, they put different weights or averages on these factors, which does little to avoid significant errors.

Competition is largely ignored:

Most pricing solutions cannot measure how you should position yourself next to your competitors.

As with costs, professionals often average or weigh competition as a factor based on gut feeling or isolated studies. However, as competition changes its portfolio more often, these generalizations become less and less accurate by the day.

In summary, inflation brings a lot of opportunities, but it is challenging to exploit using today’s tools. So, how do you succeed in leveraging inflation as a competitive advantage?

How Buynomics Helps You Succeed

With inflation as a realistic long-term prospect, the imperfections of current solutions are becoming increasingly evident. At Buynomics, we realized that a changing world requires a new solution. We leverage a clever machine learning algorithm to simulate how your shoppers react to real-life price and product changes.

This novel approach does not rely on price elasticities and avoids the pitfalls of current models, which require gut feeling to average and weigh different factors into a holistic picture.

Instead, Buynomics enables you to succeed in pricing amid inflation through four key features:

- Immediate feedback on changes in buying behavior allows you to better tailor your offering to consumer needs.

- One-click price optimization enables you to find the best price regardless of the market circumstances and cost structures.

- Portfolio optimization features offer you Price Pack Architecture (PPA) as a lever to succeed in pricing.

- Including competitors' and your own costs gives you a holistic picture of your operating context.

These benefits are possible thanks to our technology, which makes Excel and elasticities redundant.

But how does Buynomics come up with those insights?

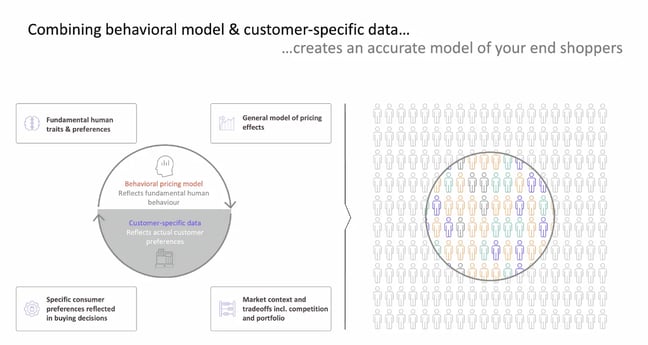

By combining behavioral models and customer-specific data, we create an accurate AI model of your end consumer called Virtual Shoppers. This model allows you to predict their actions and optimize accordingly.

Figure 1: Buynomics combines behavioral models and customer-specific data to create an accurate end-consumer model.

This makes Buynomics the machine learning solution for the revenue manager of tomorrow—for a business that is not only more dynamic but also more profitable.

Get Started Today to Reach Your Goals Tomorrow

Request a demo today to see how Buynomics supports your RGM team and helps you make data-driven decisions.

October 13, 2023

.png?width=520&height=294&name=BYN_Resources_Blog_Banner%20(9).png)

.png?width=520&height=294&name=Website%20Blog%20Featured%20Images%20(15).png)